Governance

The Board

The Board is responsible for supervising and advising our Management Team and overseeing the general course of affairs, strategy, operational performance and corporate governance of the Company.

Key Design Principles

Lean/optimal structure that drives efficiency

Aligns with the strategic objectives of the company.

Provides the required oversight functions, in line with regulatory requirements/ leading practices.

Promotes the alignment of interests of all shareholders.

Promotes accountability, with an inbuilt system of checks and balances.

Aligns with similar retail supermarkets in Nigeria.

Committees

Audit and Risk Committee (BARC)

Governance Committee (BGC)

Strategy and Finance Committee (BSFC)

Key Considerations

Consistency with leading governance practices and corporate governance requirements of NCCG 2018, SEC corporate governance guidelines and CAMA 2020.

Minimum of 5 (five) Board members.

Inclusion of a clear majority of Non-Executive Directors on the Board.

Inclusion of at least two (2) Indepense Non-Executive Directors to provide unbiased views on matters deliberated by the Board.

Membership of the committees are to be limited to Directors on the Board.

Exclusion of the Board Chairman as a member of any Committee.

Each Director should be in a maximum of two (2) Board Committees.

Audit & Risk and Governance Committees to comprise only Non-Executive Directors and be chaired by an Independent Non-Executive Director.

At least one Non-Executive Director who will be in both the Audit & Risk and Strategy & Finance Committees.

Board of Directors

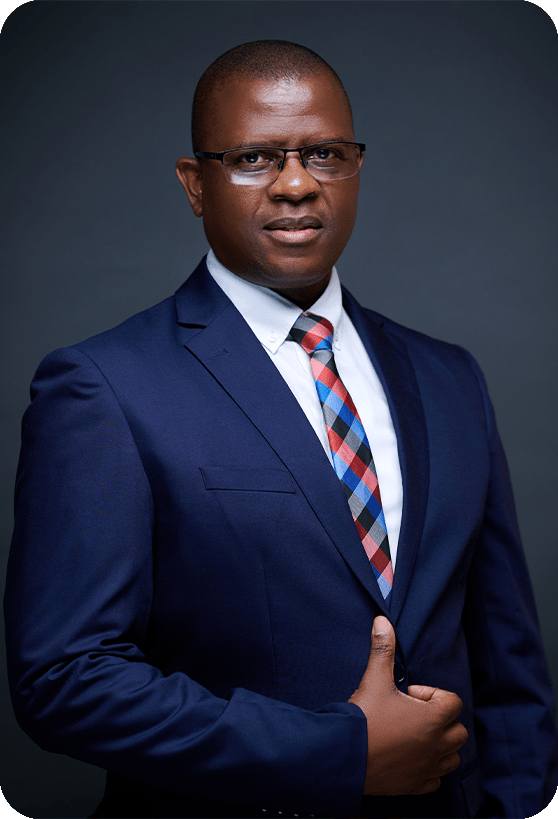

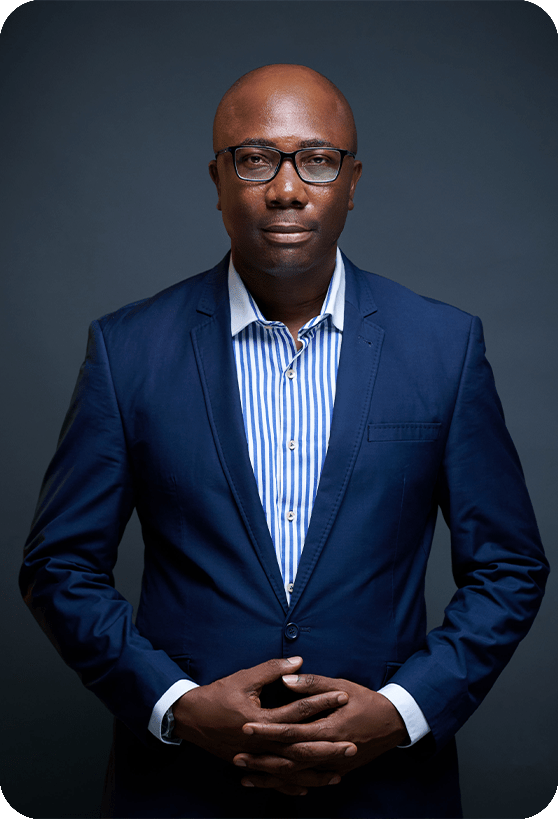

Tayo Amusan

Chairman

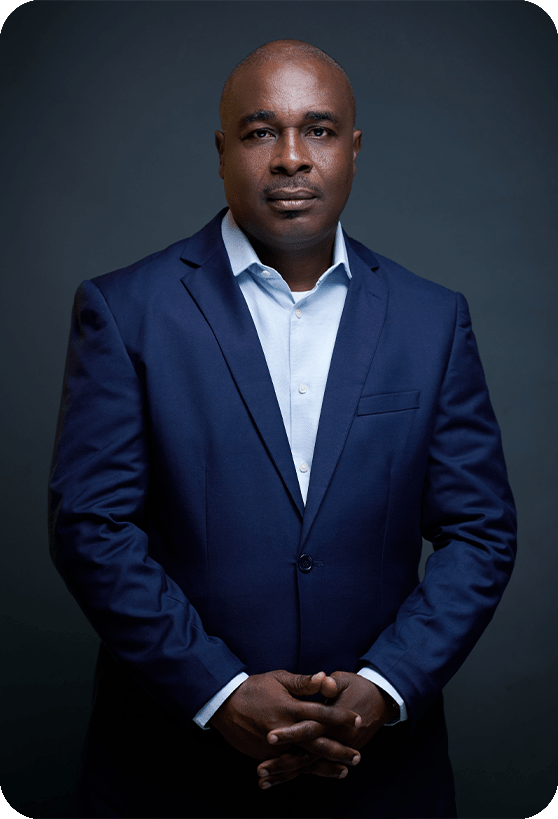

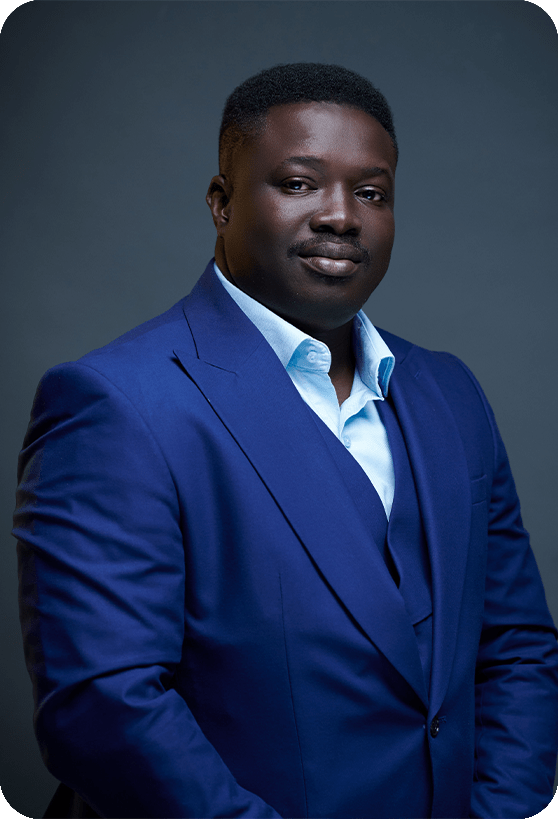

Jide Ogundare

Director

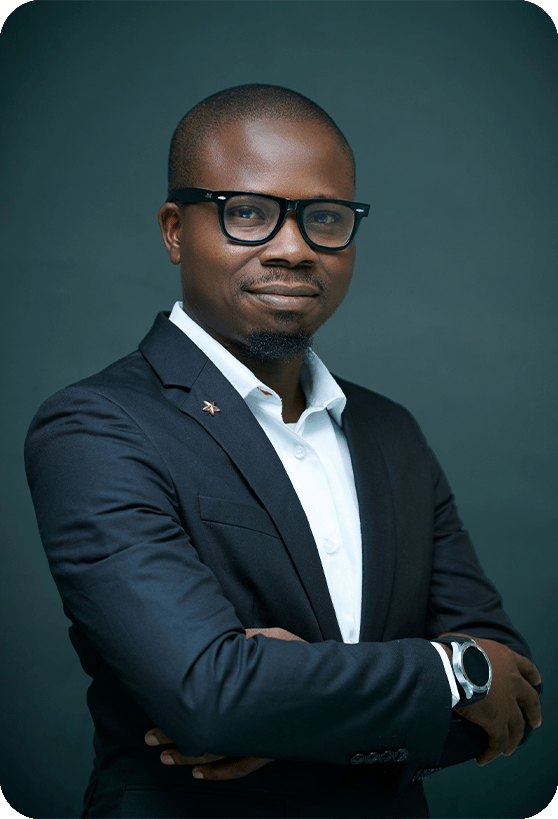

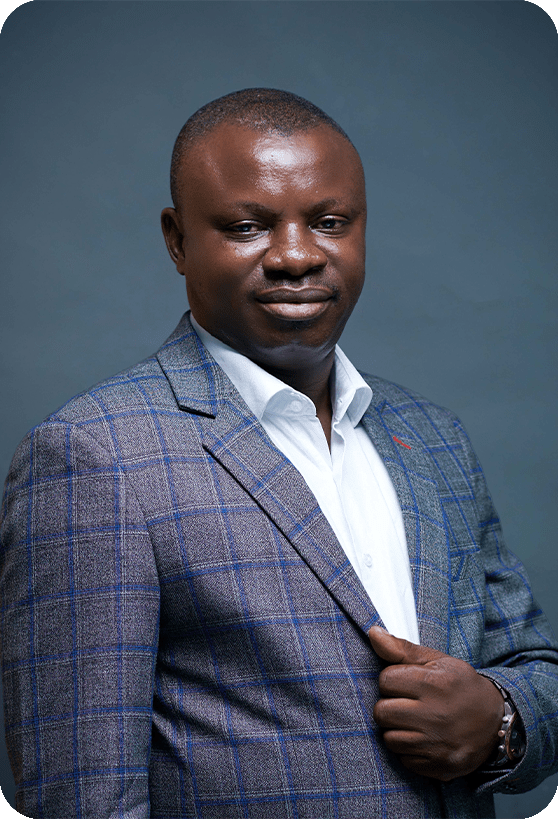

Adetunji Oduntan

Director

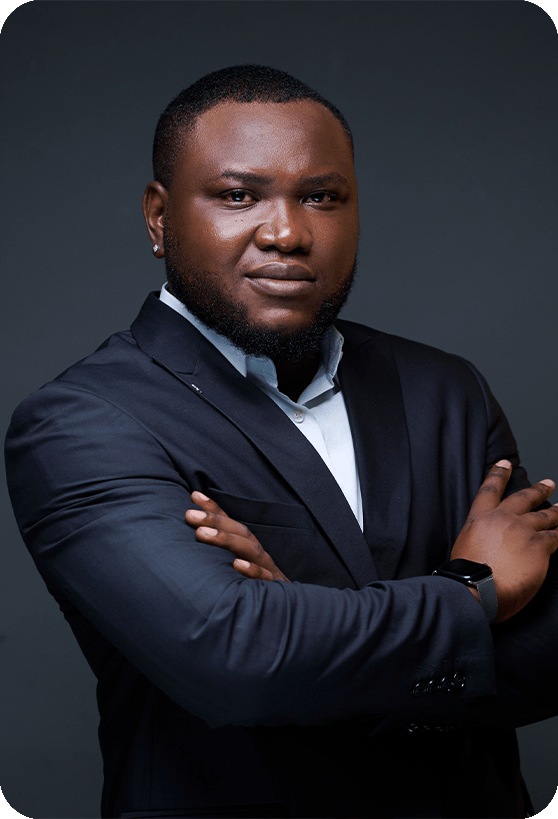

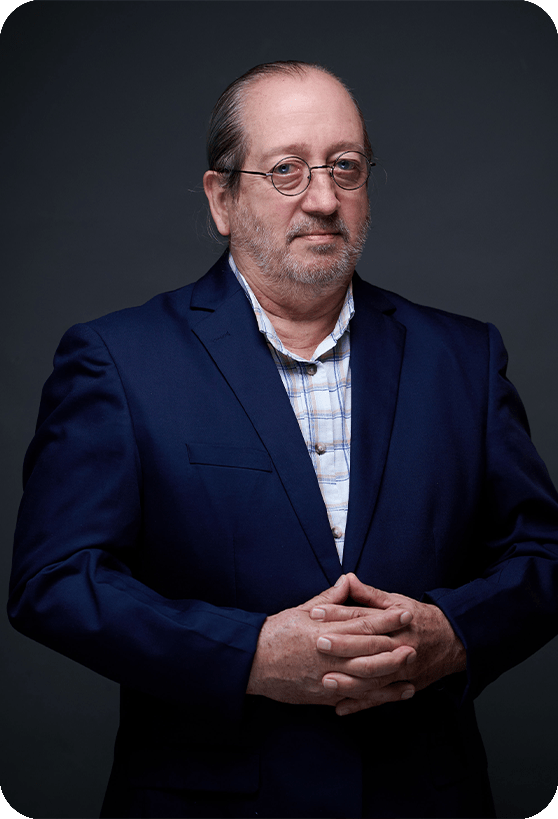

Leonard Kange

Director

Temitayo Etomi

Director

Fola Laoye

Director

Operational Management

Dr. Folakemi Fadahunsi

Interim Chief Executive Officer

Andrew Mweemba

Chief Operating Officer

Bunmi Adeleye

Chief Strategy Officer

Francis Odukuye

Chief Technology Officer

Olushola Laraiyetan

Head, Legal & Compliance

Oluwafemi Biobaku

Head, Human Resources

Babatunde Ahmadu

Head, Category Management

Uduak Okon

Head, Store Planning & Development

Renaldo Ferreira

Head, Freshmark

Isaac Arokoyo

Risk & Compliance Manager

Olowoyo Joseph

Internal Audit Manager

Gbenga Olugbami

Financial Controller

Meetings of the Board

The Board holds frequent meetings all year round. In attendance of these meetings are the Directors. These meetings are occasionally attended by the other Executive Committee members. Additionally, invitations to these sessions are frequently extended to Senior Management.

Meeting Attendance

Based on the total number of meetings held each year, the Board maintains a minimum attendance requirement of 80%.